CBA FUND

CBA Fund is a Community Development Financial Institution (CDFI) intermediary, dedicated to catalyzing and growing the capacity of nonprofits to offer small dollar, credit building consumer loans.

MISSION STATEMENT

CBA Fund's mission is to expand the capacity of nonprofits to provide safe and affordable small dollar consumer loans (SDLs) and credit building products to low- and moderate-income individuals. CBA Fund seeks to disrupt systems of oppression by actively facilitating equitable lending and credit building in BIPOC communities in a way that does not perpetuate the status quo.

about cba fund

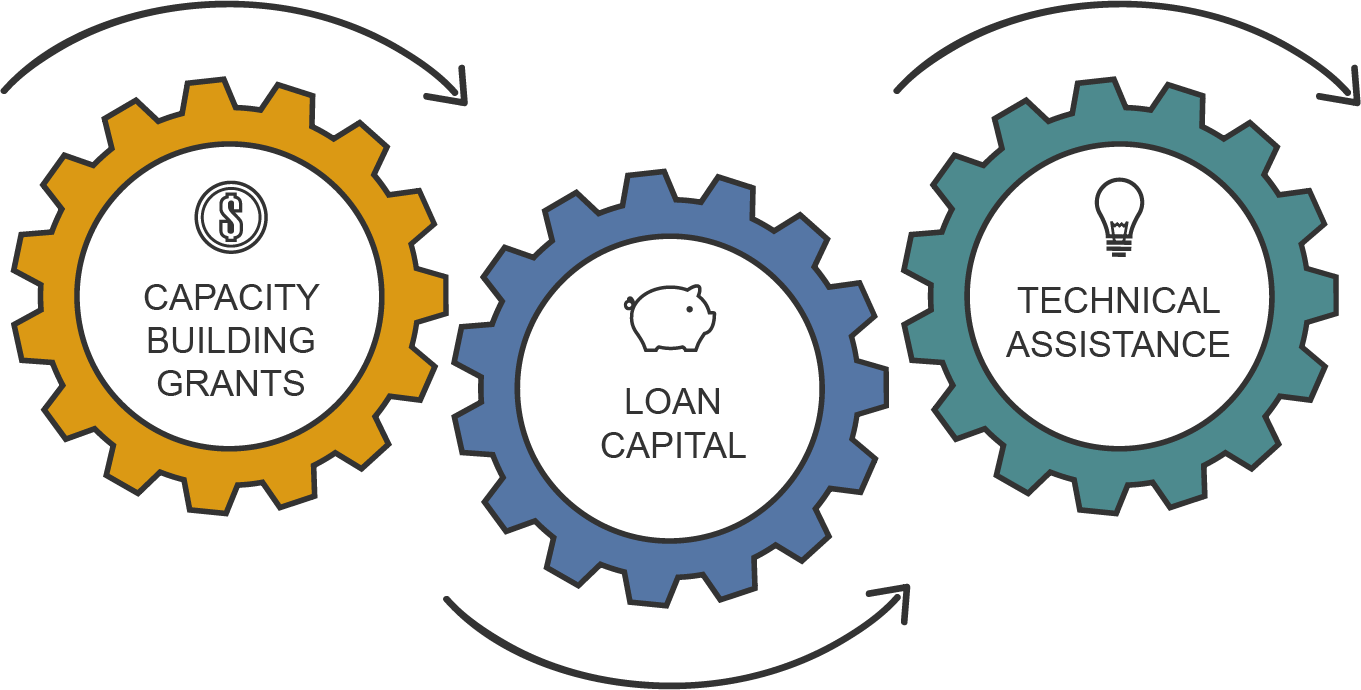

CBA Fund provides loan capital, capacity building grants, and technical assistance to nonprofits, so they can offer safe and affordable small dollar consumer loans in their community.

CBA Fund provides the solution by offering three-prongs of support to eligible nonprofit lenders:

- Capacity Building Grants: CBA Fund provides small capacity building grants to nonprofits to support the cost associated with starting, expanding, or improving upon a consumer loans program.

- Loan Capital: CBA Fund lends capital at low rates to nonprofits for the provision of small dollar consumer loans.

- Technical Assistance: CBA Fund provides individualized support for organizations seeking to implement/improve a consumer loan. In addition, we disseminate best practices, and foster community-building and knowledge sharing among nonprofit consumer lenders through our Lender Roundtable Webinars, toolkits, and other means.

cba fund staff

Interested in sharing your CBA Fund story? Click on the link below to get started.